Recently, the U.S. Department of Commerce announced that it will prohibit US companies from selling any electronic technology or communications to China's ZTE within the next seven years. For ZTE, the devastating blow lies not only in its traditional business, but also in its smart start-up car chips, operating systems and other intelligent networked automotive business.

ZTE hurts the "core" and China's "chip weakness" is again exposed.

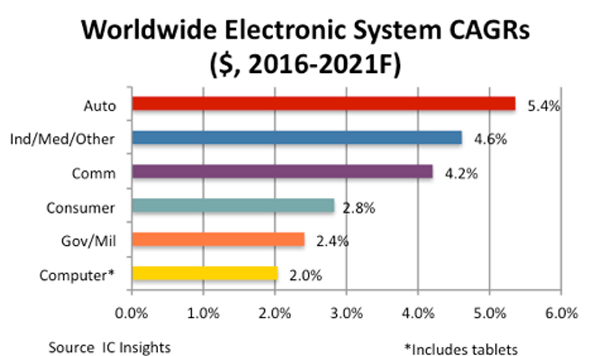

Focusing on the development of the automotive chip business, in recent years when the performance of the PC semiconductor market has been declining year by year, automotive semiconductors have maintained a sustained high growth momentum. IC Insights, a market research agency, predicts that by 2021, automotive semiconductors will become the strongest end market in the chip industry, and the compound annual growth rate of sales of automotive electronic systems products will increase by 5.4%.

Global compound annual growth rate of electronic systems, source: IC Insights

The reason is that the demand for the number of automotive interior electronic systems is constantly rising. More and more car companies, suppliers, and technology companies have turned their attention to the realization of auto-driving, V2V/V2I, and other networking functions. At the same time, auto manufacturers in various countries are gradually increasing research and development investment in electric vehicle technology. As semiconductors are key components that drive the vast majority of automotive innovations, including vision-based enhanced graphics processors (GPUs), application processors, sensors, and DRAM and NAND flash. With the increase in the complexity of automobiles, the demand for automotive semiconductor components is bound to grow steadily. Therefore, the automotive segment is a new engine for the semiconductor industry to promote its long-term development.

Although Gartner Group predicts that the profit growth rate of the automotive semiconductors business segment will be the global chip by 2020, even though the proportion of cars in other fields is only about 10% for the entire chip industry. Twice the market.

Well, at the time of the occurrence of the ZTE event, it seems appropriate to talk about the rapidly emerging automotive chip market and the opportunities for differentiation of the Chinese auto chip company in the development of its own brand “New Four Modernizations.â€

Evolving car marketTo be honest, the automotive industry has never experienced so many simultaneous changes. In the past few years, we have witnessed the integration of numerous new technologies into large-scale production models, including matrix LED headlamps, lidar sensors, and continuously optimized camera sensors. Of course, 3D map applications, electric vehicle batteries, augmented reality and other technologies have all been greatly improved, and 5G communication networks and next-generation travel solutions may soon become a reality. In addition, consumer preferences and attitudes toward cars are also changing. For example, the number of customers who have the idea of ​​“buying a car is important†continues to decline.

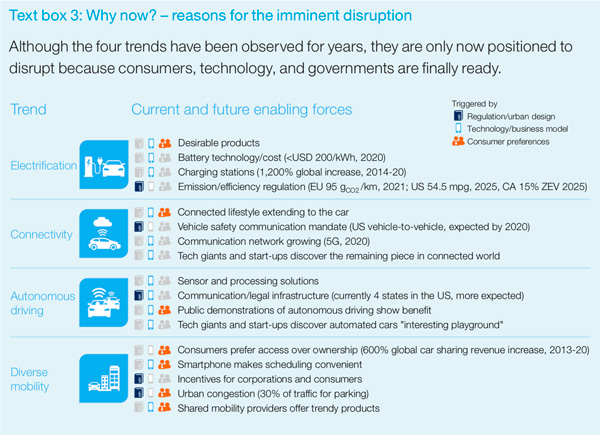

A report released by McKinsey, a consulting company, pointed out that by 2030, the global automotive industry will mainly change in the following four directions:

Electric vehicle

In the next 10 years, as battery prices continue to drop while the number of charging infrastructure increases, by 2020, the number of electric vehicles will account for 5% to 10% of new vehicle sales. Considering changes in technological progress, forms of government supervision, and changes in the prices of electricity prices, the proportion of electric new car sales will float in the 35% to 50% range by 2030.

2. Increased automotive connectivity

Whether or not a car has an interconnected function is strongly affecting consumers' purchase options, and it may have a greater impact on their decisions in the future. In the 2016 survey conducted by McKinsey, it was found that 41% of respondents stated that they had switched to other new car brands in order to obtain better internet functionality. At the same time, consumers in each country have different levels of awareness of this matter. Among them, 62% of Chinese consumers think that the interconnectedness will be a decisive factor in their purchase. In contrast, U.S. and German consumers holding the same view accounted for 37% and 25%, respectively. Correspondingly, the Internet segment will bring huge profits to auto companies. By 2020, it is estimated that the current 30 billion US dollars will soar to more than 60 billion US dollars.

3. Self-driving cars gradually landed

Although car makers are gradually introducing more ADAS functions into production vehicles, highly self-driving cars that can reach Level 4 are expected to be on their way from 2020 to 2025 at the earliest. After that, there will be a steady increase in the number of mass-produced unmanned vehicles. In the year 3030, 35% of Level 3 autonomous vehicles will be on the road, and 15% will be Level 4. However, the effectiveness of commercialization of autopilot can only be achieved by factors such as the evolution of core technologies, prices, consumer acceptance, and the ability of OEMs/parts suppliers to assess and respond to possible security risks.

4. Sharing travel services

Although the per capita car ownership rate in developed countries is increasing year by year, with the rapid launch of shared travel and car sharing and online car services, the rate of car ownership will slow down or stagnate in the future. Taking the North American market as an example, the number of consumers joining car sharing services increased by more than 400 percent from 2018 to 2015, and this figure is expected to reach a new high in the future. According to McKinsey analysts, by the year 2030, online dating or travel sharing services will account for 10% of new car purchases. This trend also prompts many car companies to share their travel plans in order to avoid lagging behind other competitors.

With the customer, technology, and government levels in place, these four major changes will lead the global automotive industry in the future: McKinsey & Company

The above-mentioned changes in the four global automotive industries are experiencing a major impact on the division and growth of the entire industry's profits. At the same time, the constant increase in revenue from travel and enhanced Internet services may be the most dramatic change. However, the impact of these four major trends is not unique, and they will also have an impact on the development of other areas.

For example, the prices of self-driving cars (L3/L4) are very high, which will lead to a rise in the profits of new car sales. In the post-market sector, the introduction of new travel services will help increase the profits of the business segment, because shared cars are faced with higher maintenance costs. However, the aftermarket is also facing the risk of falling profits and pressure, because the powertrain system for electric vehicles is cheaper to repair than a fuel vehicle, and even a self-driving car with a crash accident may be better than the same ordinary fuel vehicle. The cost is up to 90%.

Of course, whether it is ups and downs, the wave of “four modernizations†that the auto industry is experiencing will have an impact on the sources of demand for semiconductors and other parts and components companies.

Despite possible uncertainties, Che Yun believes that as the auto industry's demand for in-vehicle safety, comfort, and connectivity continues to climb, the automotive semiconductor market will see sustained growth in the medium to long term. In particular, the rapid development of autonomous driving technology will increase the change in this trend. In the long run, EV-related products will also see a substantial increase, because the hybrid models contain semiconductors valued at US$900. However, ordinary pure electric vehicles are loaded with chips worth more than US$1,000, which is far higher than the average value of 330 in traditional internal combustion engine models. The use of U.S. semiconductor products is much higher.

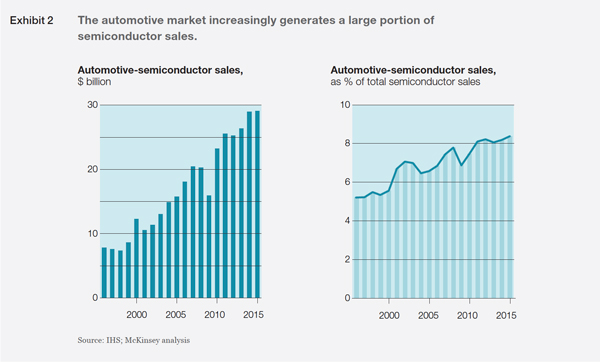

During the two decades from 1995 to 2015, semiconductor products sold to automakers increased from the initial 7 billion US dollars to 30 billion US dollars. It is precisely because of this high growth rate that sales of automotive semiconductor products account for about 9% of the current sales volume of the entire semiconductor industry. Judging from the current increase trend, the sales of automotive semiconductor products will continue to increase during the period from 2015 to 2020, resulting in an increase of 6%. The entire semiconductor industry is expected to increase sales by only 3% to 4% over the five-year period. Therefore, the annual sales of automotive semiconductors may reach a breakthrough between $39 billion and $42 billion.

Although automotive semiconductor manufacturers may face many opportunities in the future, Che Yun believes that different companies have differences in development due to differences in geographical areas, automotive product applications, and different equipment.

Regional Growth: A New Driving Force in Automotive Semiconductor IndustryAlthough the U.S. and European markets still dominate, the annual sales growth of automotive semiconductor products in the Chinese market is leading the world. From 2010 to 2015, an average increase of 15% was achieved. Some analysts predict that China’s auto semiconductor market will continue to occupy the top spot in terms of sales growth until 2020, but the average revenue is expected to decrease by 10% due to the country’s economic growth slowdown and the sharp increase in car sales resulting in a thin profit margin.

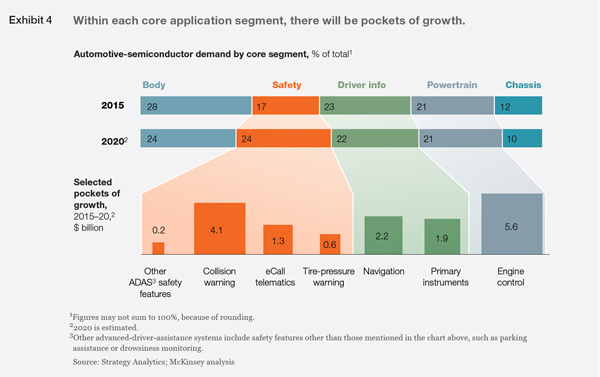

Market demand changes due to device and application segmentationIn addition to studying the development trends in different regions, Che Yun also explored the possible impact of core automotive applications and different device classifications on the automotive semiconductor market demand. The core automotive semiconductor applications currently focus on the following areas: safety, powertrain, body, chassis, and driver information. The trend shows that by 2020, the fastest growing segment will be in the security sector.

In each core application area, some products may achieve faster growth than other categories. For example, in the security field, the compound annual growth rate (CAGR) of products for collision warning systems is expected to reach 22% between 2015 and 2020, and sales will increase to US$4.1 billion. And if the long-term development trend after 2020, engine control applications (including motors and power electronics) are expected to achieve sustained growth. In addition, like the sensor fusion technology required for L4 level autopilot and the ECU in the integrated control system, the above-mentioned integrated system solution products are expected to achieve higher and faster growth.

The semiconductor market needs can be divided into different devices according to different devices: memory, micro-components, logic devices, analog devices, optical devices, sensor devices, and discrete devices. By the time until 2020, the number of electric vehicles in the world will increase rapidly. Apart from the fact that the number of semiconductors required in the car is much larger than that of traditional models, electric cars also need different types of automotive semiconductor products, which will cause market supply and demand patterns to occur. Variety. For example, automotive semiconductors used in up to 10% of conventional cars are integrated into discrete devices (power electronics). In contrast, 30% to 40% of automotive hybrids are discrete devices in hybrid vehicles, and the share of other electric vehicles is even up to 50%. Although EVs will not be widely favored by consumers before and after 2020, sales of electric vehicles have already shown a trend of increase. This means that the market demand for automotive semiconductors will also begin to change.

Similar to the core automotive application segment, each semiconductor device market segment will usher in a large number of profitable opportunities. For example, for micro-component products, the compound annual growth rate of micro-component products for micro-processors, MCUs, and digital signal processors is 14%, 9%, and 3%, respectively. After 2020, Strategy Analytics and McKinsey analysts expect that all core business will continue to grow. However, as autopilot and electric vehicles are increasingly favored by the industry, their associated applications (GPUs, sensors, etc.) are bound to perform much better than other product markets.

Strategic issues & what to do next?1 How to differentiate products?

Most of the top semiconductor companies in the industry have mentioned that placing products and R&D centers on hardware does not bring desirable value to the ever-changing automotive industry. Therefore, most companies hope to provide system solutions by adding software algorithms to their products, and some companies choose to cooperate to differentiate products. For example, Nvidia announced that it will continue to collaborate with map provider HERE, and the two companies will jointly develop real-time, high-precision maps for self-driving cars. Intel also said that it will build the Intel GO Automotive 5G platform, which allows car companies and Tier 1 suppliers to conduct design verification on products developed around 5G.

Assuming that semiconductor companies will focus on such products as system solutions, they will no longer develop additional independent chips. The advantage is that they can avoid continued financial pressure. For example, NXP Semiconductors, a Dutch semiconductor company, announced last year that it is looking at the SAF4000, a fully-integrated software radio solution for automotive IVI. NXP claims that "this is the world's first single-chip system that covers all global radio standards, including AM/FM, DAB+, DRM(+), and HD."

2 Will there be any change in the life cycle of automotive semiconductors?

In the future, as long as a car is still on the market, we may find that the frequency of car manufacturers buying chips will increase significantly. And if optional features such as IVI are no longer bundled with some of the applications associated with other hardware updates (such as powertrains), this change will see rapid development.

3 How much integration is needed to ensure redundant designs to reduce material costs?

Some semiconductor companies have tried to make the chip system into an integrated unit, and ensure redundancy by adding multiple MEMS, MCU, and other sensors. However, we must first clarify the concept of "redundancy". It means setting up two or more key components or functions in a system to increase the security of the system. For example, redundancy is mainly used for backup or fault protection. Some OEMs may find that specific redundancy designs can improve chip performance, such as adding more ECUs. Others are exploring the use of electronic remotes to steer braking or steering.

So the question is, how much redundancy can guarantee the safety of the car? And when will the participants in the automotive industry be assured that products with less redundant designs will be used? These are the key issues that limit the cost of the chip.

4 How should semiconductor companies cooperate with automakers and Tier 1 suppliers?

At present, there are more and more direct cooperation between semiconductor companies and car manufacturers and suppliers. For example, BMW, Intel and Mobileye announced that they will cooperate to build a fleet of 40 auto pilots; similarly, Audi launched a new A8 model last year equipped with a zFAS domain controller, which includes Intel, Nvidia, Mobileye The different chips provided, etc., aim to solve the auto-driving problems under highway and traffic congestion scenarios. Audi and Nvidia reached a cooperation at the CES International Consumer Electronics Show in 2017. Both parties will jointly develop artificial intelligence vehicles and plan to commercialize them by 2020.

Of course, for cooperation to succeed, semiconductor companies must first determine the scope of cooperation within which the technologies or products of the two companies can complement each other. Next, the two sides can discuss the form of cooperation: mergers and acquisitions, joint ventures, exclusive partnerships, or strategic partnerships? In the end, it is always necessary to negotiate in the direction of the interests of both parties.

5 What direction will the global automotive industry change in the future? How will such changes affect semiconductor companies?

Changes in competitive areas and value chains will affect the future development of major semiconductor companies. Some OEMs with leading edge may also occupy half of the global market in the future. Meanwhile, those companies that have long been staring at the mass market will gradually lose part of their profits as the rise of some new Chinese companies. ICT (Information and Communication Technology) suppliers in other countries will obviously feel that the market’s demand for their products is increasing, including sensors and software, which will make them play an important role in the value chain. In the end, some Tier 1 car suppliers can even bargain with some of the non-major car companies.

6 How far does the automotive semiconductor supplier go on the "safety" issue?

Although it is critical for semiconductor companies to integrate safety functions into the chip, this is not necessarily a once-and-for-all approach to solving all safety issues. For example, security threats related to network hacking. Therefore, they need to develop other security solutions, especially in the areas of automotive interconnection capabilities that are easily overlooked.

Some semiconductor suppliers such as NXP have begun to develop end-to-end security solutions with their partners in the automotive industry. Other companies can fully use their cooperation models. In addition, semiconductor companies can also find inspiration in other high-tech companies that have innovative products. For example, Bosch had previously introduced a keyless entry and start-up engine. He allowed the driver to enter the car in a safe manner. This only required a fully encrypted smart phone.

7 How to evaluate the development of China's automotive semiconductor market?

Semiconductor companies need to look at the Chinese market from several different perspectives. In addition to the continuous increase in demand for automotive semiconductor products in the Chinese market, this will also be one of the major markets for automated driving testing and high electric vehicle ownership. Part of the reason for this judgment is that China's consumer market has several special places.

A survey released by McKinsey in 2016 showed that in more than 3,000 respondents from China, Germany and the United States, compared with the other two countries, consumers in the Chinese market will have an attitude towards technologies like V2V. More open. At the same time, they are more willing to use OTA to upgrade their car entertainment information system. The above reasons have the potential to encourage and encourage auto companies to place the major battlefields for testing and marketing new automotive technologies in China. In particular, the number of Chinese auto ownership has steadily increased in recent years.

In addition, the Chinese market offers semiconductor companies a large number of differentiated cooperation opportunities. At the CES International Consumer Electronics Show in the past two years, Chinese companies have contributed more than 1,300 kinds of exhibits, accounting for more than 20% of the 500 exhibitions related to automotive technology. In the United States and other countries, there are also some potential partners, who are often Chinese companies that have just been involved in the automotive industry. For example, Baidu, the Chinese search giant, is trying to develop autonomous driving and electric vehicle technology through cooperation with global companies.

It should also be pointed out here that semiconductor companies should have confidence in the Chinese market, both from the market level and from the perspective of partners. With the formulation and implementation of the "Made in China 2025" strategy, analysts expect that the Chinese government will gradually introduce relevant preferential policies and measures to support local production and manufacturing. For example, if Chinese domestic companies want to upgrade their production lines and increase the research and development of innovative technologies, they will receive a series of preferential policies and financial support from the Chinese government on taxation. Therefore, semiconductor companies may find that there will be more and more potential partners in the future. At the same time, the Chinese government has shown great interest in autopilot and electric vehicle technology, and technologies such as the Internet of Things related to smart connected cars are also one of the projects supported by the state. At present, with the support of the government, more and more automotive and ICT manufacturers have shown very strong growth momentum in the Chinese market.

Car cloud summaryThe reality is that while many semiconductor companies have rapidly increased their investment in the development of innovative automotive products and become top suppliers in the areas of self-driving and electric vehicles, other industry participants are slow to establish cooperation with auto manufacturers. , or investment in core technologies that are of concern to car companies. A large part of the reason is that they may be reluctant to risk investing too much in a market that has not yet been formed and is still undergoing rapid changes. But the problem is that these relatively conservative companies are hesitant to repent and may soon be aggressively robbed of market share. With the automotive market's increasing role in promoting the growth of the semiconductor industry, the failure to act as the biggest risk the company faces.

Universal Bus Skylight,Roof Skylight,Bus Roof Skylight,Bus Roof Hatch Roof Skylight

Jinan JF Co., Ltd , https://www.jfsinotruk.com